Sales Tax For Dallas Tx – However, buying a business is not a decision to be taken lightly. The possibilities are endless, and the result is often something more unique and personal than what could be bought new. When a person creates something, they are offering a piece of themselves to the world, not for sale, but as a gift. In addition to offering unique items and affordable prices, many second-hand stores also serve an important social and community function. As society has evolved, the scale of production has expanded, and many quality goods are now mass-produced or distributed through large retail chains. Whether you’re the seller or the buyer, the phrase “for sale” is a reminder that everything in life is in constant motion, always moving toward something new, something different, something better. The idea that everything is for sale works to perpetuate inequality, as those with the most resources can continue to amass power and wealth, while others are left to scramble for what little they can get. Many high-quality products come with a rich history, whether it’s the legacy of a renowned brand or the personal touch of a local maker. Quality products often come with warranties and customer service support, offering peace of mind to consumers who are investing in something that will serve them well over time. This creative process not only gives new life to old objects but also encourages people to think outside the box when it comes to the things they buy and use. Brokers are well-versed in valuation, marketing, negotiation, and closing procedures, which makes them invaluable assets in the business-for-sale process. In recent years, the market for businesses for sale has been affected by several global and local economic factors. Selling such an item can be a difficult decision, yet it often represents the practical need to downsize or make space for something new. Similarly, in relationships, individuals may feel as though they are selling themselves, presenting their best qualities and hoping for the best outcome. Whether buying vintage clothing, upcycled furniture, or pre-owned electronics, the growing popularity of second-hand shopping reflects a broader desire for more sustainable, creative, and conscious ways of living. For the buyer, there is the risk of inheriting a business with hidden problems or liabilities that were not disclosed during the due diligence process. The ease and convenience of online sales have created a global marketplace where individuals can connect with buyers and sellers across the world. For fashion-conscious individuals, buying second-hand is a way to express their personal style while also supporting sustainable practices. The object becomes more than just an object – it transforms into a transaction, an exchange of value. Many people find that buying second-hand furniture allows them to acquire high-quality pieces that are built to last, often with a level of craftsmanship that is hard to find in mass-produced furniture.

Ultimate Texas Sales Tax Guide Zamp

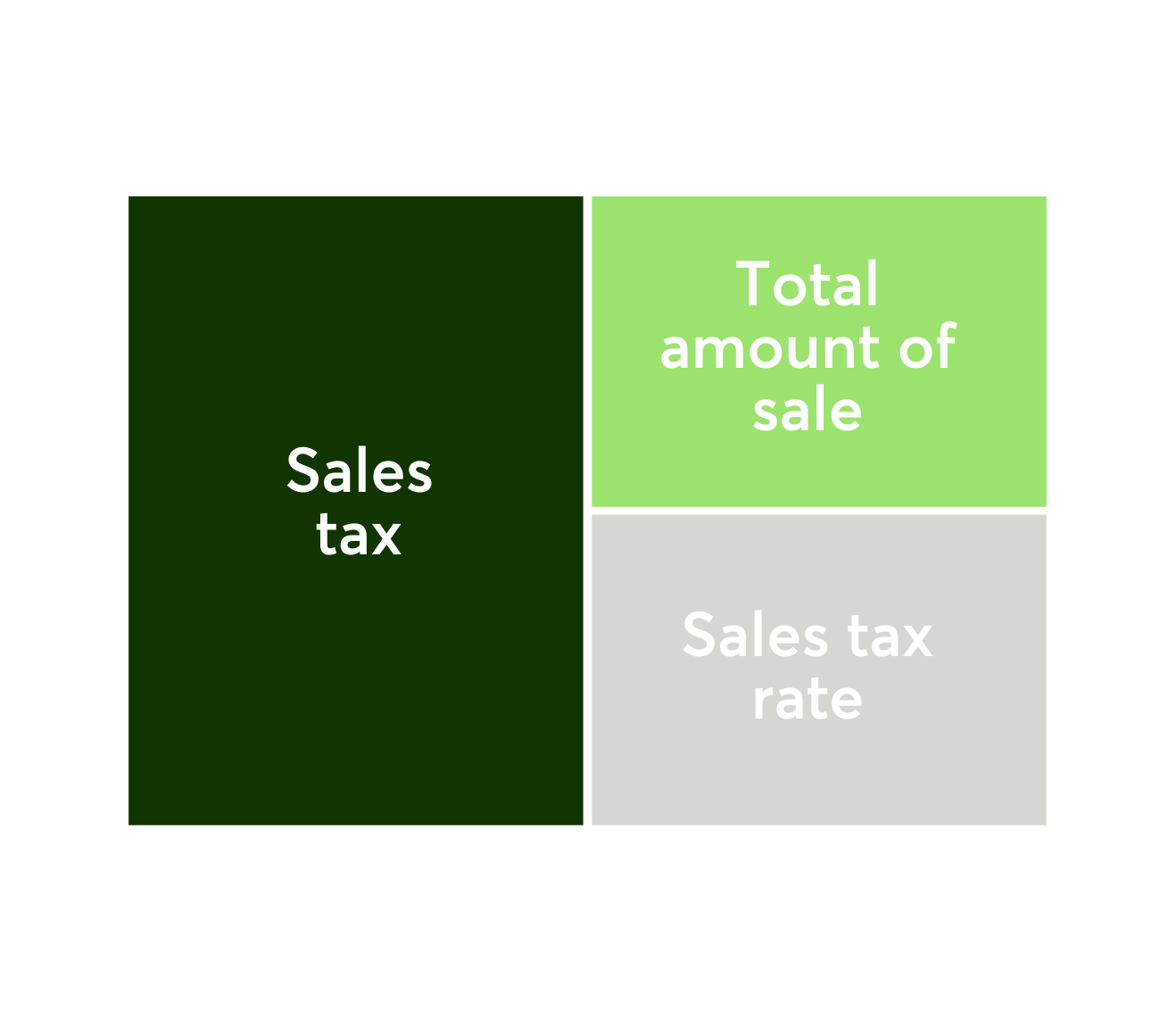

What is the sales tax in dallas? Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. The 8.25% sales tax rate in dallas consists of 6.25% texas state sales tax, 1% dallas tax and 1% special tax. For tax.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Look up the current rate for a specific address using the same geolocation technology that powers the avalara avatax rate calculation engine. A dallas county sales tax rate: Discover our free online 2024 us sales tax calculator specifically for dallas, texas residents. What is the sales tax in dallas? This is your total sales tax rate when you combine the.

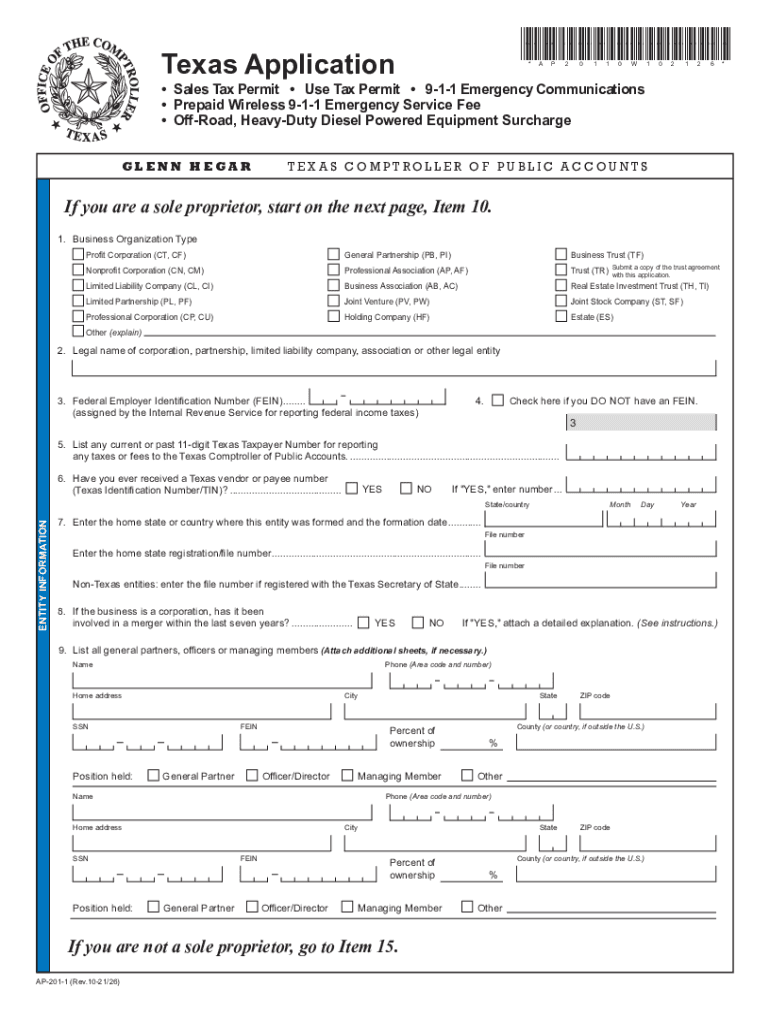

Texas “Sales & Use Tax Permit” y el “Resale Certificate” Todo lo que

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The dallas sales tax rate is 1.0%. You don’t pay any county tax in dallas. Tax rates can vary within a county, a city, or even a zip code. You can print a 8.25% sales.

Texas Sales Tax Guide for Businesses

The texas state sales tax rate: Dallas has a combined sales tax rate of 8.25%. The current sales tax rate in dallas, tx is 8.25%. The 8.25% sales tax rate in dallas consists of 6.25% texas state sales tax, 1% dallas tax and 1% special tax. You don’t pay any county tax in dallas.

Texas Sales Tax Calculator and Local Rates 2021 Wise

A dallas county sales tax rate: Tax rates can vary within a county, a city, or even a zip code. You can print a 8.25% sales tax table here. Dallas has a combined sales tax rate of 8.25%. This is your total sales tax rate when you combine the texas state tax (6.25%), the dallas city sales tax (1.00%), and.

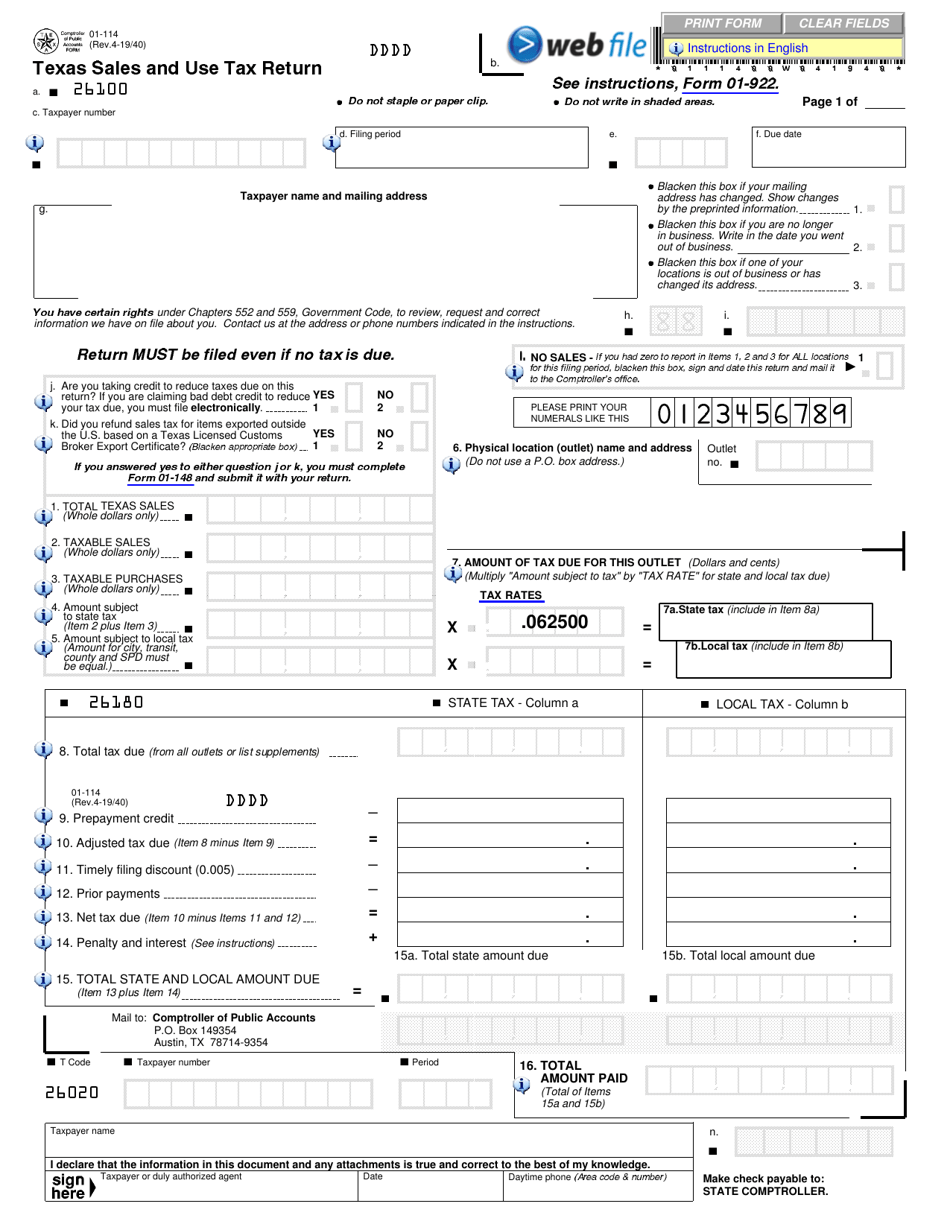

Form 01114 Download Fillable PDF or Fill Online Texas Sales and Use

Look up the current rate for a specific address using the same geolocation technology that powers the avalara avatax rate calculation engine. Tax rates can vary within a county, a city, or even a zip code. The combined sales tax rate for dallas, texas is 8.25%. The dallas sales tax rate is 1.0%. The 8.25% sales tax rate in dallas.

2024 Guide to Sales Tax in Dallas, Texas

The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists of a 1.00% city sales tax and a 1.00% special district sales tax (used to fund transportation districts, local attractions, etc). Look up the current rate for a specific address using the same geolocation technology that.

Texas Sales Tax Chart

What is the sales tax in dallas? For tax rates in other cities, see texas sales taxes by city and county. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists of a 1.00% city sales tax and a 1.00% special district sales tax (used to.

Sales Tax In Dallas Texas 2024 Birgit Juliette

The 8.25% sales tax rate in dallas consists of 6.25% texas state sales tax, 1% dallas tax and 1% special tax. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. Discover our free online 2024 us sales tax calculator.

What Is The Sales Tax In Texas 2024 Lotta Mildrid

What is the sales tax in dallas? You don’t pay any county tax in dallas. The current sales tax rate in dallas, tx is 8.25%. Dallas has a combined sales tax rate of 8.25%. For tax rates in other cities, see texas sales taxes by city and county.

The global marketplace, with its constant buying and selling, influences everything from politics to the environment, creating ripple effects that are felt far beyond the immediate transaction. The growing interest in second-hand goods can also be attributed to shifting cultural attitudes toward consumption. The internet, for example, has created a space where anyone can buy or sell almost anything, from physical products to intangible services. With the rising costs of new products, especially in categories like electronics, clothing, and furniture, purchasing second-hand items can offer significant savings. It implies that there’s nothing off-limits, nothing beyond the reach of commerce. This has made it easier for people to find items that might have otherwise been out of reach, whether it’s a rare collectible, an antique, or a product from another country. With just a few clicks, consumers can browse through thousands of listings for second-hand items from all over the world. For example, someone might be able to purchase a used smartphone or laptop with the same features and specifications as a brand-new model, but at a significantly reduced price. For instance, when someone is job hunting, it can feel like they’re placing themselves on the market, waiting for the right offer. In this sense, online second-hand markets have not only made pre-owned goods more accessible but have also made them more desirable, offering an alternative to the mass-produced, one-size-fits-all nature of new products. In conclusion, quality goods for sale represent the best that craftsmanship, design, and functionality have to offer. One of the key defining features of quality goods for sale is their ability to stand the test of time. For many, owning a quality product means owning a piece of history, a connection to something larger than themselves. Sellers can list items with detailed descriptions and high-quality photos, giving potential buyers a clear understanding of what they are purchasing. It involves an in-depth understanding of the business’s financials, operations, and market position. The rise of online platforms has transformed the way second-hand goods are bought and sold. Many everyday products, such as kitchenware, footwear, and tools, can also be considered quality goods, provided they are made to last and perform well over time. Art, music, literature — these expressions of human creativity and emotion are not always bound by the rules of commerce. Thrift stores often carry a wide variety of goods, from clothing and accessories to furniture, books, and electronics, and each item comes with its own story. The focus on longevity and reliability is what sets these goods apart from their mass-market counterparts.

It’s a phrase that, at first glance, may seem simple and straightforward. When someone buys a second-hand item, whether it’s a piece of furniture passed down through generations or a retro jacket from a bygone era, they are not just acquiring an object; they are connecting to a story, a memory, or a cultural moment. Buying second-hand goods has numerous advantages. Second-hand record stores and online marketplaces like Discogs have become hotspots for vinyl enthusiasts, providing a platform for buying, selling, and trading records. It forces us to ask difficult questions about ownership, worth, and the limits of human desire. The act of selling can be both a release and a renewal, a letting go that paves the way for something new and unknown. But even as we wrestle with the implications of living in a world where everything is for sale, we also see that this reality is not entirely negative. Social media platforms, for example, offer users a chance to buy into their own identity, to curate a version of themselves that is more appealing, more desirable, more marketable. They are investments, not just purchases, and their value is often felt long after the original transaction has ended. The decision to sell an heirloom piece of furniture, for example, can be emotionally complex, as it involves a shift in one’s connection to the past. The growing appeal of second-hand goods is also tied to a growing awareness of environmental issues. People can be bought and sold in the form of labor, for example, and loyalty can be traded for material gain. A piece of art, for example, may be valued differently by various individuals based on personal taste, financial resources, or the emotional connection they feel to the work. Whether it’s vintage clothing, antique furniture, or used luxury watches, second-hand goods offer an opportunity for buyers to find quality items that are no longer available in stores. It doesn’t fall apart after a few uses, nor does it need to be replaced after a season. Are there things that should be kept beyond the realm of trade? Or has the marketplace — with its insatiable demand and promise of exchange — seeped into every facet of our being?

If everything is for sale, then the concept of value itself becomes fluid, subjective, and often manipulated. The process of selling it can be seen as a form of letting go, a recognition that the future may look different from the past, but that doesn’t diminish its importance or value. While the sale of a business can provide a valuable opportunity for both parties involved, it also carries risks. With just a few clicks, consumers can browse through thousands of listings for second-hand items from all over the world. In conclusion, the sale of a business is a complex process that involves numerous steps, from identifying the right buyer or seller to completing due diligence and negotiating the terms of the transaction.