Sales Tax For Santa Clara County – In some cases, selling second-hand items can be a way to make a significant profit, especially if the items are rare, vintage, or in high demand. When a business is put up for sale, it is typically the result of a variety of reasons, each unique to the situation at hand. Many quality goods are made by artisans or small businesses who take the time to create products that reflect their expertise and passion. Beyond practical reasons, the appeal of quality goods for sale also lies in the sense of pride and satisfaction that comes from owning something well-made. Similarly, a quality suit made from fine wool will age gracefully, developing a patina that speaks to its craftsmanship. They also often help with legal and financial aspects, ensuring that the transaction is completed smoothly and efficiently. Websites and apps like eBay, Craigslist, Facebook Marketplace, and Poshmark have made it easier than ever to find second-hand goods for sale, offering a wider selection and more convenience than traditional brick-and-mortar stores. In recent years, the market for businesses for sale has been affected by several global and local economic factors. Those who are born into privilege have the means to buy their way to the top, while others are left behind, forced to sell their time, energy, and even their dignity in order to survive. The materials used, whether it’s hardwood, durable fabrics, or premium upholstery, are chosen for their longevity and aesthetic appeal. For many, purchasing second-hand goods is not just about saving money, but about embracing sustainability, supporting a circular economy, and contributing to a more environmentally conscious world. When people choose quality goods, they are choosing longevity over convenience, enduring craftsmanship over temporary trends, and often, a timeless aesthetic over what is in vogue today. This can manifest in the context of career, relationships, or personal goals. It’s easy to understand why people seek out quality goods for sale. Just as with material possessions, when a person is “for sale,” they put their value on display for others to assess. In some cases, the sale of an item can mark a pivotal moment in someone’s life. If the buyer is satisfied with the findings, the next step is usually negotiation. While the sale of a business can provide a valuable opportunity for both parties involved, it also carries risks. The global marketplace, with its constant buying and selling, influences everything from politics to the environment, creating ripple effects that are felt far beyond the immediate transaction. In the realm of real estate, for instance, selling a house is often an emotional and logistical challenge.

California Tax Deadline 2024 Santa Clara County Mandy Rozelle

California > orange county > meredith parkwood. Santa clara, ca is in santa clara county. The combined sales tax rate for santa clara, california is 9.13%. Sales tax calculator to help you calculate tax amount and total amount. Santa clara sales tax rate is 9.13%.

Santa Clara County Sales Tax 2024 Hilde Laryssa

This is the total of state, county, and city sales tax rates. The applicable sales tax rate may vary depending on the type of purchase (e.g., goods, services, or special categories). 2026 e santa clara avenue c3 santa ana, ca 92705. What is santa clara county sales tax? The december 2020 total local sales tax rate was 9.000%.

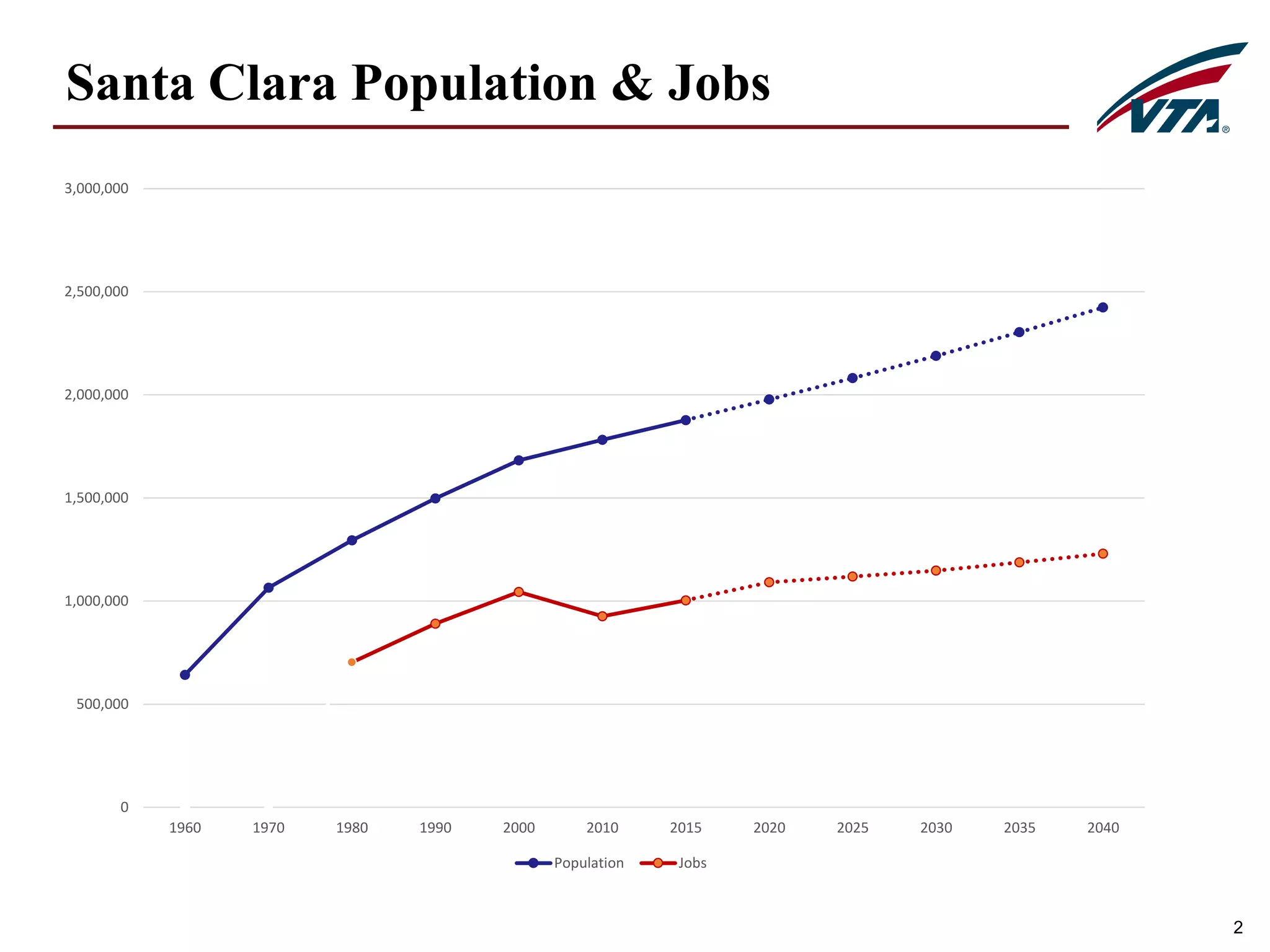

Santa Clara County Past Sales Tax Measures PPT

Santa clara county’s sales tax rate is 0.125%. The different sales tax rates like state sales tax, county tax rate and city tax rate in santa clara county are 6.00%, 0.25% and 0.24%. The latest sales tax rate for santa clara, ca. There is no applicable city tax. However, often county sales tax rates are lower than the sales tax.

Santa Clara Sales Tax 2024 Carena Muffin

The current sales tax rate in santa clara county, ca is 9.88%. The sales tax rate in santa clara is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax. Breakdown of sales tax rates in. The combined sales tax rate for santa clara, california is 9.13%. The applicable sales.

Measure A County of Santa Clara Sales Tax YouTube

The current total local sales tax rate in santa clara county, ca is 9.125%. You can print a 9.125% sales tax table here. In santa clara the total sales tax rate, including county and city taxes, ranges from 9.125% to 9.375% city rate: Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara.

Shadow poll tests new sales tax in Santa Clara County San José Spotlight

The applicable sales tax rate may vary depending on the type of purchase (e.g., goods, services, or special categories). The december 2020 total local sales tax rate was 9.000%. Breakdown of sales tax rates in. The combined sales tax rate for santa clara, california is 9.13%. There is no applicable city tax.

Santa Clara County Past Sales Tax Measures PPT

California > orange county > meredith parkwood. The applicable sales tax rate may vary depending on the type of purchase (e.g., goods, services, or special categories). This is the total of state, county, and city sales tax rates. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage..

Santa Clara County supervisors push sales tax measure for November

Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara county sales tax (1.00%), and the special tax (1.88%). There are a total of 467 local tax jurisdictions across the state, collecting an average local tax of 2.712%. Easily look up rates and estimate sales tax for santa clara county, california with our.

Santa Clara Sales Tax 2024 Carena Muffin

2026 e santa clara avenue c3 santa ana, ca 92705. This rate is comprised of two parts: Santa clara doesn’t levy a city sales tax. Please note, unincorporated cities and communities are not listed below. Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara county sales tax (1.00%), and the special tax.

Santa Clara County Sales Tax 2024 Dodie Lyndel

For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The applicable sales tax rate may vary depending on the type of purchase (e.g., goods, services, or special categories). State sales tax and local option sales tax. The total sales tax rate in santa clara comprises the california.

One of the primary reasons people turn to second-hand goods for sale is financial. It can be a metaphor for much deeper exchanges in life. Unlike mass-produced items that may become outdated or fall apart with minimal use, quality products are designed to endure. The idea of buying things that were once owned by someone else is no longer considered taboo or lesser; rather, it has become a lifestyle choice for those who want to make smarter, more ethical purchasing decisions. It forces us to ask difficult questions about ownership, worth, and the limits of human desire. The perceived high cost of these items has led some to opt for cheaper alternatives. Additionally, many second-hand items are still in excellent condition, having been gently used or well-maintained by their previous owners, further enhancing the appeal of these products. They are investments, not just purchases, and their value is often felt long after the original transaction has ended. We start to treat people as commodities, too — as means to an end, as tools for achieving personal success or social status. There’s a certain art to selling something. When someone talks about purchasing quality goods, they are likely thinking of items that have been designed to last, to provide a superior experience, and to offer a sense of value far beyond the initial cost. Online marketplaces have opened up opportunities for people to buy and sell goods from the comfort of their own homes. Whether buying vintage clothing, upcycled furniture, or pre-owned electronics, the growing popularity of second-hand shopping reflects a broader desire for more sustainable, creative, and conscious ways of living. It is only through diligent research that a buyer can truly determine whether the business is worth the asking price. In some cases, a business may look profitable but may be hiding significant underlying issues, such as declining sales, ineffective marketing strategies, or employee dissatisfaction. These platforms often provide tools that help streamline the due diligence process, including access to financial documents, business valuations, and other relevant data. Whether through thrift stores, flea markets, online platforms, or garage sales, second-hand goods provide consumers with an opportunity to find items they might not otherwise be able to afford, while also contributing to a circular economy where products are reused and repurposed. A car is something that can hold a great deal of sentimental value. This is especially true in a world dominated by fast fashion, disposable electronics, and mass-produced products. The idea that everything is for sale works to perpetuate inequality, as those with the most resources can continue to amass power and wealth, while others are left to scramble for what little they can get.

These brick-and-mortar stores offer a different shopping experience, one that is often characterized by the thrill of the hunt. For the seller, the goal is often to maximize the value of the business, which requires a clear understanding of the company’s assets, liabilities, and future earning potential. The idea of “buying quality” is not just a luxury; it’s a mindset that encourages consumers to think beyond the momentary gratification of cheap purchases and focus instead on long-term value and satisfaction. A well-made product simply performs better. With the rising costs of new products, especially in categories like electronics, clothing, and furniture, purchasing second-hand items can offer significant savings. In this digital age, it often feels like there’s no such thing as privacy anymore, and that’s because we’ve essentially agreed to sell pieces of ourselves in exchange for recognition, affirmation, or even money. But what about the intangible things? Can memories be bought? Can feelings, emotions, or connections be traded? In a sense, many people would argue that in today’s world, even the intangible is up for grabs. Yet, despite this shift, the appeal of quality craftsmanship has not waned. The second-hand market is not just about saving money; it’s about embracing a more sustainable, mindful way of consuming that values reuse, repurposing, and the stories behind the items we choose to keep. Online platforms also offer the convenience of searching for specific items, whether it’s a rare collector’s item, a particular brand of clothing, or a piece of furniture that fits a specific design style. Electronics are another category of second-hand goods that have seen a rise in popularity. Social movements and grassroots organizations work tirelessly to provide resources and support to those who need it, often without expecting anything in return. One common concern is the risk of purchasing items that are damaged or not as described. Many people find that buying second-hand furniture allows them to acquire high-quality pieces that are built to last, often with a level of craftsmanship that is hard to find in mass-produced furniture. In a circular economy, items are kept in use for as long as possible, reducing the need for new resources and minimizing environmental harm. The growing interest in second-hand goods can also be attributed to shifting cultural attitudes toward consumption. Relationships can become transactional, where each party enters into an agreement based on what they stand to gain. Sometimes, a sale can feel like the closing of one chapter and the opening of another. Online platforms also give buyers and sellers the chance to evaluate one another through reviews and ratings, adding an extra layer of trust and security to the transaction. Second-hand items are typically sold for a fraction of their original price, making them an attractive option for individuals on a budget.